Understanding Property Tax Protests in Texas: What Property…

Property tax protests in Texas are a critical right available to property owners, yet many do…

We help homeowners and businesses across Texas reduce over-assessed property values with no upfront fees and proven tax protest strategies.

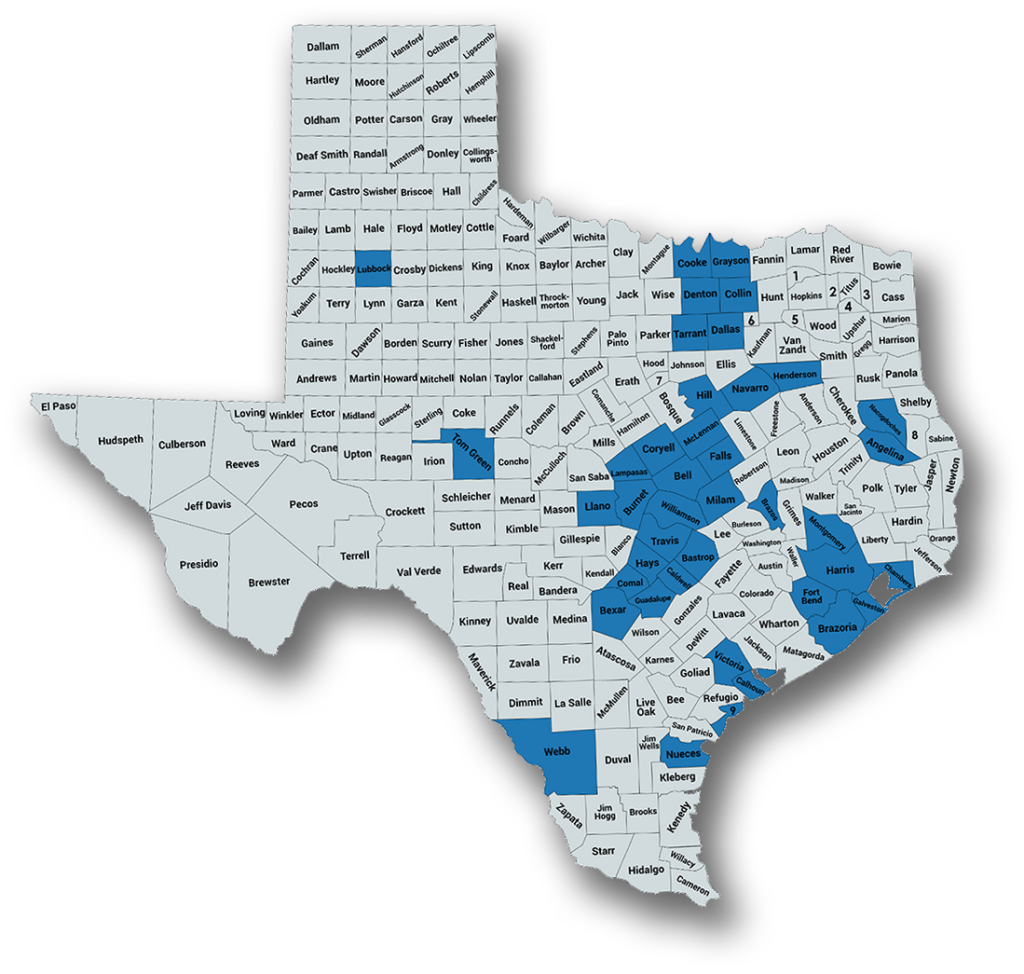

The Woodlands Property Tax Group helps Texas homeowners and businesses reduce unfair property tax assessments through expert analysis and professional representation. We focus on fair valuations, local expertise, and results from Central Texas to counties across Texas, we’ve got you covered.

Our Story

Texas-based property tax consultants with years of experience working directly with local appraisal districts to protect property owners from over-assessment.

Our Mission

Help property owners across Texas lower their property taxes through strategic protests, clear guidance, and trusted representation.

What Sets Us Apart

Personalized service, local Texas knowledge, and no upfront fees, you only pay if we successfully reduce your values.

You only pay when we secure a reduction in your property's appraised value.

We understand Texas appraisal districts, local valuation practices, and county-specific protest procedures.

We represent homeowners, businesses, and commercial property owners with tailored strategies for each property type.

Every case is supported by detailed market data, comparable analysis, and professional valuation review.

We handle filings, negotiations, hearings, and appeals on your behalf, so you don’t have to navigate the process alone.

We are not a call center. Each client receives direct support and clear communication from experienced professionals.

Documented results demonstrating our expertise in residential and commercial property tax consulting.

Property tax protests in Texas are a critical right available to property owners, yet many do…

Property taxes in Texas can represent a significant expense for homeowners, business owners, and real estate…

Property taxes in Texas continue to rise year after year, affecting homeowners, commercial property owners, and…

(254) 293-6003

Satellite Office – The Woodlands, TX

(281) 591-4873

We review your property’s assessed value, analyze market data and comparable properties, and file a formal protest with the county appraisal district. Our team represents you through negotiations or hearings when necessary, aiming to achieve a fair and accurate valuation.

If we are unable to reduce your property’s assessed value, you do not owe any fees. Our services are performance-based, meaning you only pay if we successfully lower your assessment.

Yes. We provide property tax consulting and protest services for residential properties, commercial and industrial real estate, and business personal property, using strategies tailored to each property type and county.

Our Google reviews highlight real results, expert guidance, and a proven track record in property tax consulting.

Trustindex verifies that the original source of the review is Google. We are very pleased with this company! They helped us successfully reduce our property taxes and made the entire process easy. Their customer service was amazing, they were great to work with, very reasonably priced, and most importantly, they got the job done right. We would highly recommend them to anyone looking for this service!Posted onTrustindex verifies that the original source of the review is Google. This is the 2nd year Woodlands Property group has protested property appraisal for me. Both times they have done an excellent job. They are very easy to deal with and handle everything. I highly recommend them.Posted onTrustindex verifies that the original source of the review is Google. The Woodlands Property Tax Group fought for us and got our property tax value down by $93,000!!! Awesome!Posted onTrustindex verifies that the original source of the review is Google. These are the best. I had problems filing my County taxes. Presto-change-o. All is correct now. Thank you.Posted onTrustindex verifies that the original source of the review is Google. Woodlands is a locally operated agency that you can trust. They have a proven track record that is people focused and results driven.Posted onTrustindex verifies that the original source of the review is Google. Every year I protest my taxes, Woodlands has saved me tens of thousands of dollars. Better yet they are local , doesn’t get any better than that!Posted onTrustindex verifies that the original source of the review is Google. Josh and Paige at Woodland Property Tax Group have been absolutely outstanding to work with. The first time we used them was for a commercial property, and they achieved a reduction in value to one even lower than the year prior. Most recently, they represented us in arbitration on multiple properties and prevailed on every single case. Over the years, they have also handled protests for us on agriculture exemptions, business personal property, personal property, and even property under construction. Their professionalism, deep knowledge of the tax system, and persistence in delivering the best possible outcomes have saved us significant money and time. They are responsive, detail-oriented, and genuinely care about protecting their clients’ interests. Without a doubt, they are the best in Bell County, and their fees are more than fair for the services they provide. If you need a team you can trust to navigate the complexities of property tax protests, I highly recommend Woodland Property Tax Group.Posted onTrustindex verifies that the original source of the review is Google. Paige and The Woodlands Property Tax Group have done it again! We were “WOW’d” by their services this year. They make what is a daunting process simple, efficient, and honestly exceptional. I’m thankful to have a LOCAL and outstanding option for navigating home taxes in our area.